A BALANCED ECONOMY

Public spending is essential for prosperity, and so is private spending.

Both goverement and business are necessary, to achieve a fully functioning society.

Quality of life is determined by investments made in both social and economic development.

One key to prosperity is a Balanced Economy, with equal amounts of public and private spending.

Considering how social spending and free enterprise are both important for a fully functioning society, a balanced economy is the healthiest economy.

Neither America nor China has a balanced economy, at least not yet. Nor does Europe or Russia, but they're all going in that direction.

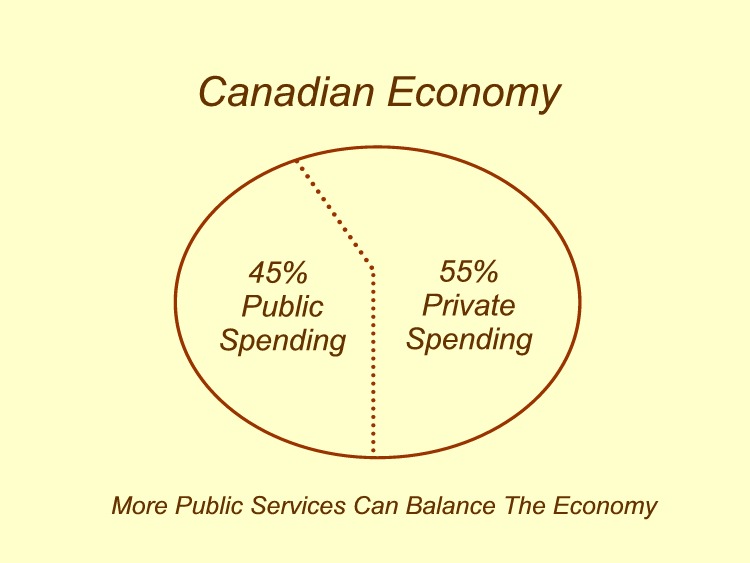

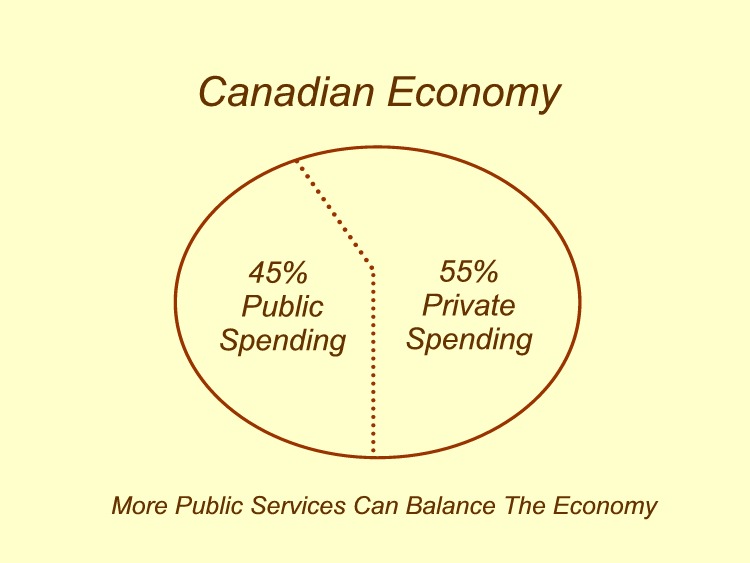

Canada has a more balanced economy than America, Europe, Russia and China, but even Canada would have to increase public spending from 45% to 50% of the GDP in order to achieve a truly balanced economy.

As the Canadian economy is approximately 45% Public Spending and 55% Private Spending, there is some room for increasing Public Spending.

This provides opportunities for municipal government budgets to be expanded, as a way of helping the country achieve a more balanced economy.

MUNICIPAL GOVERNMENTS CAN

HELP BALANCE THE ECONOMY BY

INCREASING MUNICIPAL TAXES.

Taxpayers can vote on public spending priorities

with public evaluations of government programs.

With a Public Service Scorecard, people can

vote for where their tax dollars go . .

You can complete a sample public service evaluation at

Public Service Score - Pop Survey

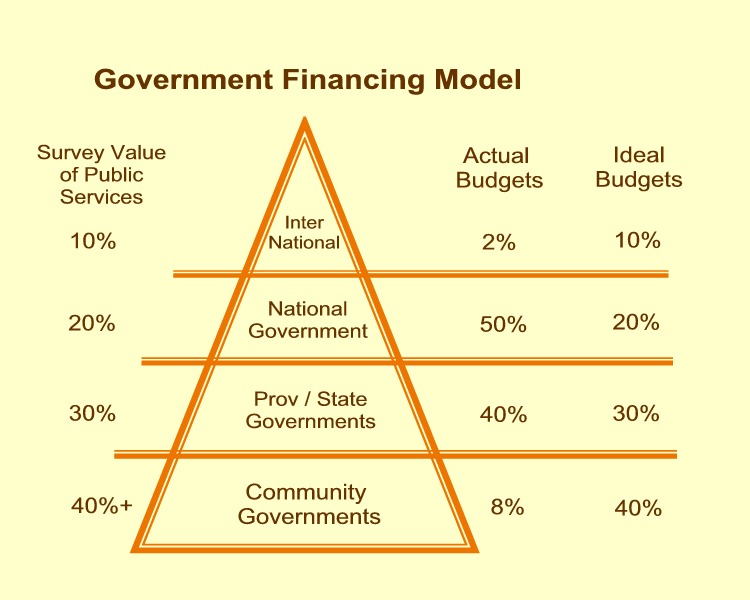

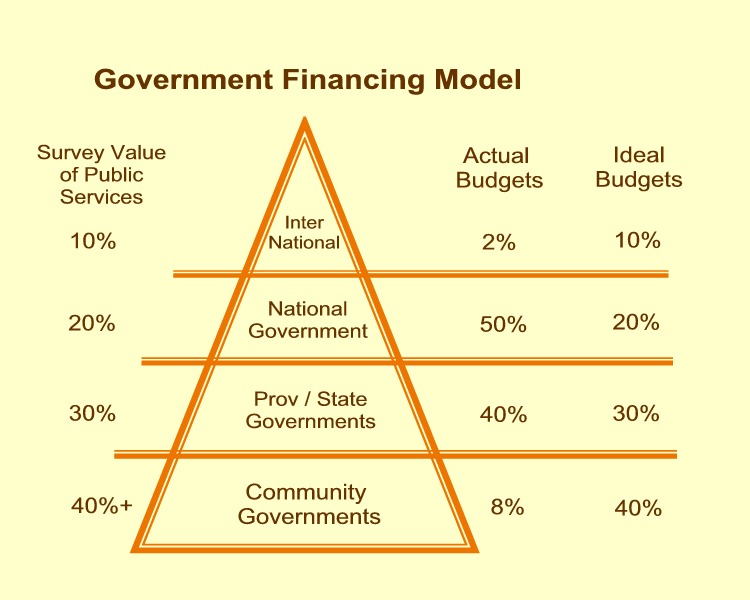

Research shows that Communities currently provide an estimated 40-60% of the Public Services people value most. However, Communities only receive 8-9% of our tax dollars to do all this work.

On the other hand, federal governments receive approximately 50% of our tax dollars, to provide an estimated 20% of our most valued public services.

It's obvious to most people that the federal government is over-funded, and local government is under-financed.

This problem exists in many countries. Over-financed federal governments and under-financed municipal governments are a common problem, around the world.

It is therefore proposed that 30-40% of all national income tax revenues, in every country around the world, should be allocated for municipal governments and community councils.

An ideal funding formula would divide income tax revenues in this way - one third of income tax revenues for municipal governments, one third for states and provinces, and one third for the federal government. The balance of 10% can be allocated for the UN and other international agencies.

The proposed CCA Government Funding Formula is based on the principle of government sharing of tax revenues, as a percentage (%) of responsibilities, as evaluated by voters.

This is how modern solutions to urban problems can be found, with a better government financing formula.

Community Income Tax Credits

In Canada, the fiscal framework for allocating tax dollars makes communities unworkable, for one reason - The Federal Government claims to have a monopoly on income tax revenues, but it isn't true.

This federal monopoly assumption can be challenged in court. The provinces sued for a share of income tax revenues in the 1930s, and the provinces won their case.

Modern municipal problems can be corrected by changing the constitution to allow municipalities to receive Community Income Tax Credits.

How this can work . . .

Based on the legal precedent of how provinces obtained a share of income taxes in the 1930s, Communities can demand their right to receive a fair share of income tax revenues, from the federal government, which is the nation's tax collector.

Or, people can write a check to their community, and obtain a Community Income Tax Credit, which can be used as a tax deduction on a person's federal tax bill.

As an experiment, at tax time, write a check to city hall, and deduct the amount from your national income taxes. For example, pay half of your federal tax to your municipality, and use this amount as a federal income tax deduction on your annual tax form.

The feds might throw people in jail for claiming Community Tax Credits, but if lots of people do the same thing, constitutional change could follow.

Community Income Tax Credits could be a long term strategy, but it is possible, if communities can organize themselves as a Community Commonwealth to demand a fair share of income tax revenues. Taxes can remain at the same level, or taxes can be raised, to achieve a more balancedf economy, if that's what voters want.

The Bottom Line -

Whatever government financing formula is used, and whether it requires a constitutional change or not, municipalities have a legal right to receive a fair share of income tax revenues, so they can provide public services for their community.

If you would like to participate in the creation of a better world,

campaign for Community Income Tax Credits by joining the

Community Commonwealth.

www.communitycommonwealth.info

Public Service Evaluation Survey